Maria Eva Virginia Grabowski Mitsotakis

She is the wife of Kyriakos Mitsotakis, Prime Minister of Greece, she is involved in an offshore network of tax-based companies such as the Cayman Islands , which have become known for serving and laundering black money.[1]

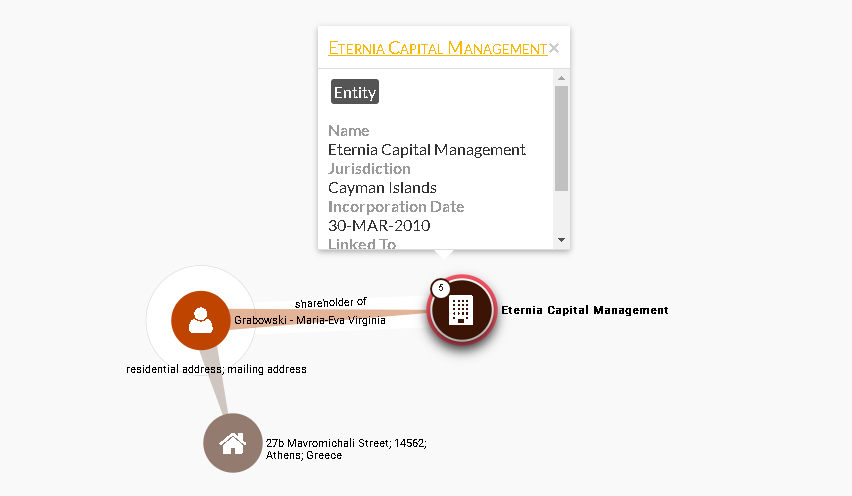

Maria Eva Virginia Grabowski Mitsotakis as a shareholder of an OFFSHORE company named Eternia Capital Management based in Cayman Islands that is forgotten and never reported to the Greek Tax Authorities as required by law, her income and any other extracurricular activities of unknown origin related to the said offshore legal entity in Cayman Islands .

The woman with many names also has many “faces” besides millions well-hidden moneys of unknown origin and indeterminate “color”, as she turns out to be a recipient of money from an offshore Panamanian company so called Velvet Success SA

Velvet Success SAThe money was deposited in the company “ZEUS & DIONE SA” where the wife of the Prime Minister of Greece besides a major shareholder is the President and Managing Director.

Maria Eva Virginia Grabowski, Mitsotakis also happens to be a collaborator of persons who have starred in a number of scandals in Greece, tax scandal under the code name “Lagarde List” such as Stavros Papastavros of the offshore companies Green Shamrock, Diman and Aisios foundations Panama-based and in partnership with Goldman Sachs Europe Emmanuel Gavaudan f. Chief Executive Officer Goldman.(See here)

It turns out to serve a great deal of tax evasion and money laundering cases through a complex network of offshore companies, concealing its interests together the dirty money it distributes through its lobbying companies such as ZEUS & DION title “ZEUS & DIONE SA” which comes from the renaming of the company MG CAPITAL ADVISORS ASSOCIATES SERVICES SA with the distinctive title MG CAPITAL ADVISOR SA which was managed jointly with the well-known corrupt Stavros Papastavros.

η MG Capital Advisor που εγινε ZEUS & ΔΙΟΝΕ Α.Ε wAll of this would not have been possible without the protection veil afforded to her by Kyriakos Mitsotakis politician and today’s the Prime Minister of Greece, along with the political and economic power of the Family of her husband Mitsotakis and her powerful associates such as the well-known Stavros Papastavros with offshore companies Green Shamrock, Diman and Aisios foundations based in Panama, the members of the Lascarides family with offshore company Velvet Success SA based in Panama that injecting money in hers business activities in Greece.

Maria Eva Virginia Grabowski Mitsotakis as a shareholder of the Cayman Islands -based OFFSHORE Company Eternia Capital Management, which forgot to declare to the Greek tax authorities as required by law its income and any other offshore business activities of corrupt and illegal origin.

While in its current business activities in Greece – at the site of its protection and informal immunity – the Panamanian offshore company Velvet Success SA was found to be the financier of its business activities Maria Eva Virginia Grabowski Mitsotakis at ZEUS & DIONIS EONISM AND FOOTWEAR, with the distinctive title “ZEUS & DIONE SA” which comes from the renaming of the company MG CAPITAL ADVISORS ASSOCIATES SERVICES SA with the distinctive title MG CAPITAL ADVISOR SA which was managed jointly with the well-known scandalous Stavros. https://offshoreleaks.icij.org/stories/stavros-papastavrou the launderer of SIEMENS bribes on behalf of the Political Party of Greece NEW DEMOCRACY and a host of Greek politicians.

The Panamanian company Velvet Success SA is of the interests of the Laskaridis family known for corruption scandals that have never been investigated by the corrupt state of affairs in Greece’s Public Prosecutors and Courts. Laskaridis’ interest is demonstrated by the involvement of the three trustees associated with the Laskaridis family who appear as DIRECTORS of Velvet Success SA. The same persons are systematically encountered in many family businesses while appearing as board members of Venture Ability, which invests in the UK Hotel. In the investment, according to the bank’s newsletter, the three are handling money from the Laskaridis family.

Maria Eve Virginia Grabowski Mitsotakis apart from been shareholder in ZEUS & DIONE CLOTHING & FOOTWEAR TRADING COMPANY, under the distinctive title “ZEUS & DIONE SA” reg. number “7638901000” is also the Chairman of the Board of Directors & CEO.

According to the minutes of the general meeting of Zeus & Dione on June 16, 2017 a capital increase of EUR 1,487,000 was approved. The old shareholders are relinquishing some of their rights to raise capital for a new shareholder: The Panamanian offshore company Velvet Success SA which is Laskaridis’ s family interests with no hitherto economic activity.

Maria Eve Virginia Grabowski Mitsotakis – Mitsotakis Grabowski – Maria-Eva Virginia is well acquainted, with many strange coincidences proving many unrealistic purchase prices of land and houses in Greece, France and elsewhere that show the modus operandi in dirty money laundering.

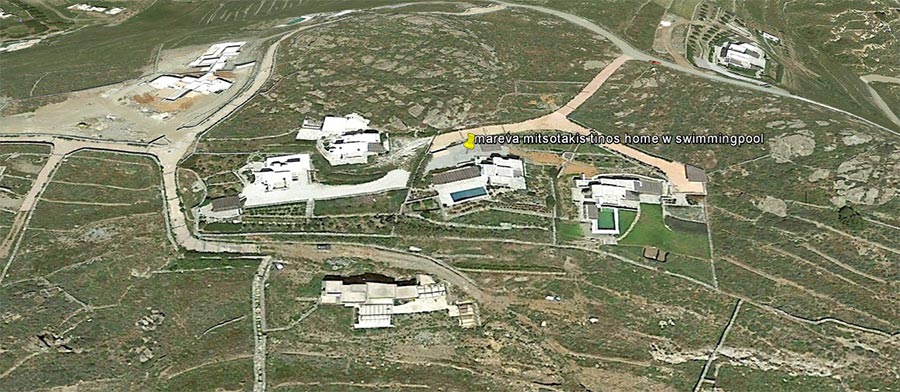

One of these many cases of current wife of Kyriakos Mitsotakis Mrs Mareva Grabowski is the odd coincidence of the acquisition of a plot and the newly built luxury villa of 415.85 square meters with a pool of 68.55 square meters on the island of Tinos that shared on a plot of land with the “strong man” and manager of the “black funds” of the German company in Greece SIEMENS wanted by Interpol Michalis Christoforakos and then high-level executive Dionysis Dendrinos.

Coordinates 37°35’20.21″N 25° 4’40.46″E

To date, no one Greek Prosecutor has questioned the corrupt and illegal activities of the wife of then-President of the political party New Democracy and current Prime Minister of Greece Kyriakos Mitsotakis, how of the deplorable sum of 62,486 euros according to the notarial contract – Purchase Agreement of the plot that is priced over 800.000 euro, and from an offshore company based in the exotic islands of St. Vincent and the Grenadines in the Caribbean. Not the fact that they like the Caribbean tax paradise too much, they bring and take the black money back and forth from the Caribbean, but they all buy and sell among themselves at whatever price they want in Greece, and they all live in Greece except for the ones wanted by Interpol as is Michalis Christoforakos today;

In the same area on the island of Tinos that Maria Eva Virginia Grabowski Mitsotakis – Mitsotakis Grabowski – Maria-Eva Virginia buys an 8,000-square-foot plot of land, later building a traditional 415.85-square-foot luxury cottage. swimming pool 68.55 square meters the Mitsotaki couple have neighbors Dendrinou and the owners of the offshore company Mystras Holding based in the tax haven of Saint Vincent and the Grenadines, in which the main shareholder whom is wanted by Interpol today Mr. Michalis Christoforakos,.

Mitsotakis is not secret that is a close friend with Mr Christoforakos, as is his ex-wife, who works as an employee at the Deutsche Bank branch in Athens headed by ‘neighbor’ in Tinos properties Mrs Dendrinou.(SEE HERE)

No one Greek Prosecutors in Greece responsible for the ECONOMIC CRIME no one controller agent of the TAX Authorities of GREECE ever attempted to investigate the wrongdoings of Prime Minister Kyriakos Mitsotakis wife Maria Eva Virginia Grabowski Mitsotakis not even the reasons of obtaining a discount 750.000 EUROS TO BUY LAND VALUE 810.000 euro from an offshore company MISTRAS HOLDING LIMITED owned by the Interpol wanted person Mr. Michalis Christoforakos.

According to information, the adjacent plot of Mareva Mitsotakis, on the island of Tinos, appears to have been purchased by his own offshore company Mistras Holding Limited, with Siemens Christoforakos for 810,000 euros, while the adjacent plot was purchased by Siemens Dendrinos with same price i.e. 810,000 euros with the wife of Prime Minister Kyriakos Mitsotakis’ wife at the time and they built 3 huge villas. However, the wife of Kyriakos Mitsotakis, the current Prime Minister of Greece, bought it for only 62,486 EUR i.e. Mistras Holding Limited hasgiven her a 750,000-euro discount.

Apparently someone, or some decided to make a… gift from many to the Mitsotakis family! Only that they all turned out to be person that have stolen from the Greek State billions and receive bribes of millions not limited to Siemens black money. The relationships of the Mitsotakis family with the German agent over time and with Siemens executives in Greece are also well known. After all, Christoforakos even sponsored telephone call centers and home appliances that the big political family needed further from caviar and champagne.

Gifts Siemens-Mitsotakis_wIt is recalled that Christoforakos and Dendrinos were the managers of Siemens’ black funds. The offshore company Mistras Holding Limited looks like it was operating as a laundry company, set up by Siemens black fund managers to launder black money through the purchase of plots in the Greek islands.

Offshore Mistras Holding Limited, based in the tax haven of St. Vincent and the Grenadines, Trusthouse 112 Bondie Street has been involved in many other land sales in both the Attica and Aegean islands, such as Antiparos, Spetses, and Tinos. Many of them ended up with politicians with virtual bargains and purchases of great discounts in order to funnel bribes.Similar Cases here

Corruption in Greece at its large interfering with French jurisdiction since Mitsotakis couple buying in Paris a 1.500.000 euro “Voltaire’s house” with only 10,000 euro capital company.

Μητσοτακαινα αγορα τιμημα σπιτι στην γαλλια_wWhere, following the revelation about the shadowy purchase of the property ‘de plume Voltaire’ home in Paris, the Greek prime minister’s wife was forced to transfer the shares of company ‘SCI PERSONAL VENTURES’ incorporation number: 490793288 FREE OF CHARGE in 2017 which has only EUR 10,000 share capital through which it bought the expensive real estate APARTMENT in Paris on 1 RUE DE BEAUNE 75007 PARIS, FRANCE on July 11th from the property management company of Pierre Cardin (known as Pierre Cardin House) on the prestigious address on Seine that was Voltaire’s place of residence ) In an attempt to thereby be relieved of undeclared intimate Paris turned into property crime evidence and that s not only by the Greek law.

The statement on where in 2017 (fiscal year 2016) states that the French company SCI Personal Ventures through which Voltaire’s home was purchased in 2006 has been transferred (NB: Free Transfer). This is not a coincidence, since this French-based company owns Voltaire’s home, as reflected in the 2016 asset declaration. In the company “SCI PERSONAL VENTURES” the prime minister’s wife participated by 95%, while the rest is owned by her elegantly brother. Due to the free transfer, the Prime Minister’s spouse’s participation in the company in question in the 2018 Statement of Essentials 2018 (fiscal year 2017) is nowhere to be seen.

The story of the Paris home and the money of 725,000 euros cash was not justified anywhere, but as it is proven to be a well-known and well-made trick to avoid declaring assets in the case your husband is the Greek Prime minister, otherwise you end up in jail. On June 16, 2006, Kyriakos Mitsotakis, as a Member of Parliament and a debtor, filed a letter to the relevant Parliamentary Committee informing that his married life had been disturbed and that he was in the process of divorcing his wife. On June 30, Mr. Mitsotakis files his estate statement without including his wife. On the same day the prime minister’s wife devilishly set up SCI Personal Ventures in Paris. The company is 95% owned by her the wife of Prime Minister Kyriakos Mitsotakis and 5% by George Papazisis.

σχετ εταιρεια Μητσοτακαινα γαλλια σπιτι SCI PERSONAL VENTURES_wThe share capital of the company is just 10,000 euros.

According to documents filed by Mareva Grabowski herself, the 1,470,000-euro (though much larger) PARIS home in FRANCE was purchased by a 900,000-euro which was loan from GE Money Bank to SCI Personal Ventures and with 570,000-euro cash contributions from an equity that the company never had, nor ever given an explanation !!!

In addition to all that a 154,000 euros were paid for taxes and real estate expense.

Consequently, the house was not bought solely on loan but also on cash and it follows that the remaining 724,000 Euros were left, which the company gave out of equity and the question arises as to where this amount was found as the capital was only 10,000 Euros.

Questions also arise from the fact that in the 2016 ‘Where are you’ statement (2015), Kyriakos Mitsotakis, who now declares Mareva Grabowski as his wife again, says Mrs Grabowski is a 95% shareholder in SCI Personal Ventures , who owns the Voltaire home, but the source of the purchase is a “loan”. It is thus concealed that the house was purchased not only on a loan but also with cash of € 725,000 and has not been clarified to date.

In the next year’s statement in 2017 (2016), Kyriakos Mitsotakis states that there is a change in the company SCI Personal Ventures, which was allegedly transferred to someone as a “free transfer”. In this way the company tried … to erase the evidence of the crime, with no result.

From the official documents that the company is currently registered in Paris (registration number 490 793 288 RGS Paris) it is clear that Mareva Grabowski has been a shareholder and director of the company until today.

The case of corruption, laundry money and non-disclosed information to Tax in Greece is CLEARED after a given recommendation by the head of the Anti-Money Laundering Authority Mrs Anna Zaire, who is also a Vice-Attorney of the Supreme Court, and by that the company, with just 10,000 euros of share capital, paid 1.500.000 euros which obviously do not exist in the equity from which the rest of the money and is paid for the purchase of the house in Paris and no one asks the Prosecutor in Greece but also in FRANCE their origin !!!

Mareva Grabowski’s Controlled Whereabouts was related to the 2015 financial year and how Voltaire’s home was bought in Paris, if it had been wholly acquired through a loan or cash payment of € 725,000.